Business Risks

Olympus Corporation applies the regulations in Note (31) listed in Form 2 of the “Cabinet Office Order on Disclosure of Corporate Affairs” following amendment in accordance with the “Cabinet Office Order Partially Amending the Cabinet Office Order on Disclosure of Corporate Affairs” (Cabinet Office Order No. 3 of January 31, 2019).

The business performances of the Olympus Group may be materially influenced by various risks (uncertainties) which may occur in the future. The Olympus Group is implementing risk management initiatives to achieve its “basic management policy,” which includes its management philosophy, corporate strategy, etc. Specifically, based on the “Policy of Risk Management and Crisis Response” and related rules, the Olympus Group is undertaking risk management from the perspective of both “offense” through active and appropriate risk taking for leading to sustainable growth and value creation for Olympus Corporation and “defense” to prevent illegalities and accidents.

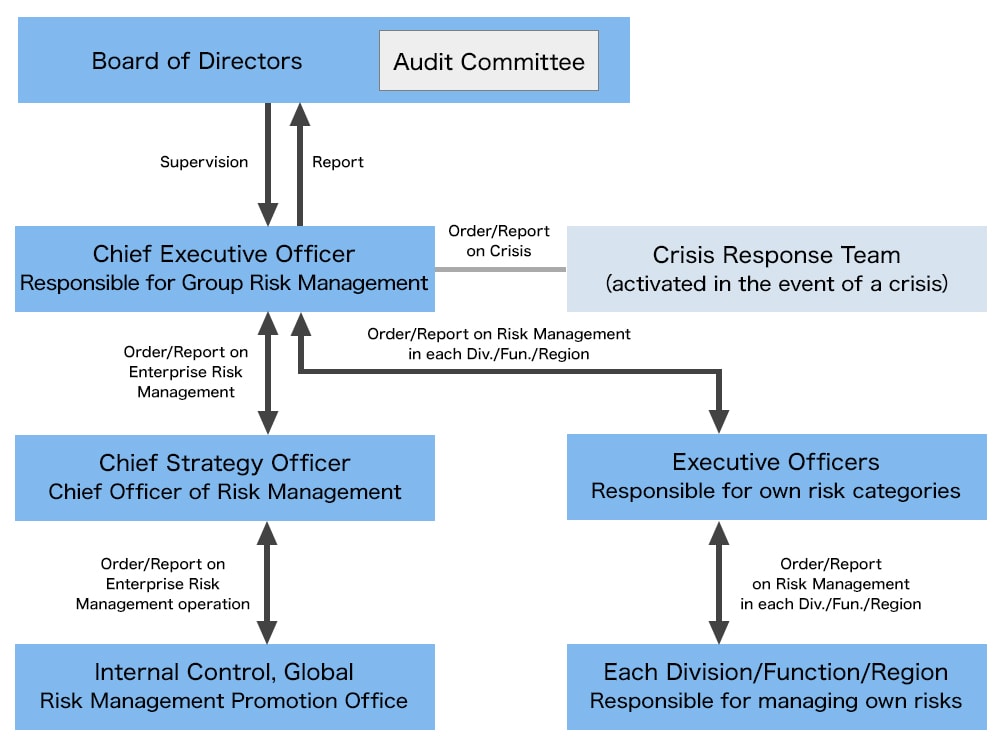

In terms of risk management systems, we have established a global risk management system, defined categories of risks that could affect the achievement of Olympus Corporation’s business targets as well as the corporate strategy, and identified the Executive Officer responsible for each risk category (establishing risk assurance). Each Executive Officer executes the necessary measures (organizational structure, process preparation, focus measures, etc.) to keep within the permitted scope of their designated area of risk.

In April 2023, we launched a new organization to integrate the four functions (risk and control, compliance, privacy, information security) related to GRC (governance, risk, compliance). In order to enhance coordination among the different functions, we have worked to further strengthen our risk management system with respect to execution capabilities.

The Olympus Group also operates risk management processes with a PDCA cycle of risk assessment (identification, analysis and evaluation of risk and setting countermeasures), implementation of risk countermeasures, monitoring and reporting, and improvement. Risk assessment is linked to the process for formulating the fiscal year plan, with risk evaluated using common company-wide evaluation standards, and company-wide risk tracked and uniformly managed. In addition, the status of response to the Olympus Group’s significant risks are regularly reported to the Olympus Group Executive Committee, the Board of Directors, and the Audit Committee for ongoing monitoring.

< Risk Management System > (Fiscal Year Ended March 31, 2023)

< Risk Management to Achieve “Basic Management Policy” >

Set out below are our principal business risk factors, aside from managerial decisions made by the Olympus Group, which may affect Olympus Group’s business performances.

The future outlooks described below are based on the forecasts of the Olympus Group made as of the end of the fiscal year ended March 31, 2023.

< Company-wide Significant Risk Map >

< Company-wide List of Significant Risks >

| Category | Risk | Type | Impact/Urgency | Trend |

|---|---|---|---|---|

| Business Environment | Risks Associated with Medical Administration, Tightening of Product-related Laws amd Regulations and Infection Prevention | Oppos. & Threats | A | ↑ |

| Risks Associated with Market Competition | Oppos. & Threats | A | ↑ | |

| Market | Risks Associated with Economic Environment | Oppos. & Threats | C | ↑ |

| Risks Associated with Foreign Currencies Exchange Rate Fluctuations | Oppos. & Threats | D | ↑ | |

| Risks Associated with Financing | Oppos. & Threats | D | → | |

| Business Activities | Risks Associated with Development Activities | Oppos. & Threats | A | → |

| Risks Associated with Supply Chain | Oppos. & Threats | A | → | |

| Risks Associated with Business Collaborations, Corporate Acquisitions, Sale of Business and Overall Investment and Others | Oppos. & Threats | A | → | |

| Overall Management | Risks Associated with Compliance | Threats | D | → |

| Risks Associated with Litigation | Threats | D | → | |

| Risks Associated with Information Security | Threats | A | ↑ | |

| Risks Associated with Human Resources | Oppos. & Threats | A | ↑ | |

| Risks Associated with Taxation | Threats | D | → | |

| Sustainability Risks, including Those Related to Climate and the Environment | Oppos. & Threats | C | → | |

| Natural Disasters, Infectious Diseases, War, Civil War and Other Risks | Threats | C | ↑ |

Recent Changes in the Business Environment

Our awareness of the basic environment that affects the entire Olympus Group is provided below, and we identify risk and evaluate response policies both as an entire company and on an individual organizational level.

| Political | Geopolitical | The possibility of export controls on cutting-edge technologies caused by intensifying trade friction between the U.S. and China impacting the business performances of the Olympus Group. We have prepared response policies (BCP formulation, etc.) that considers war and conflict. |

|---|---|---|

| Economical | Macro-economy | Global inflation, interest rate fluctuations, and sudden exchange fluctuations rooted in complex factors such as international economic friction, the levying of economic sanctions, shortages of key raw materials, and deterioration in supply-and-demand balances. |

| Social | Stakeholders | Demands from the standpoint of sustainability are increasing from global and regional stakeholders, and the legal rulemaking around information disclosure is accelerating. |

| Technological | New technologies | Diversification of business models and competitors. Acceleration of DX and robotics, rapid commercialization, evaluation of medical applications, and legal rulemaking for AI. |

Risks Associated with Business Environment

Risks Associated with Medical Administration and Tightening of Product-related Laws and Regulations and Infection Prevention

- Type: Opportunity and threat

- Level of Impact/Urgency: A

- Tendency: Increase ↑

Risks

In the medical field, healthcare system reforms are being continuously implemented in Japan and overseas with the aim of curbing medical care costs and improving the quality of life (QOL) of patients by improving the safety and efficacy of healthcare services. As a result, legal and regulatory requirements for medical device applications and registrations in each country, including the US Food and Drug Administration (FDA) and European Medical Device Regulations (EU-MDR), are increasing every year. In addition, the requirements concerning infection prevention and reprocessing (i.e., cleaning, disinfection, and sterilization) are becoming more complex.

The Olympus Group’s earnings may be adversely affected if: (i)-a the Olympus Group fails to launch new products or services in a timely manner based on such amendments or changes and/or (i)-b the Olympus Group otherwise needs to take certain actions corresponding to such amendments or changes by (ii) healthcasre laws and regulations or related administrative porlicies. On the other hand, early detection of signs of changes in healthcare policy in different countries can lead to reliable responses to specific laws and regulations or to planned changes in operations.

We are currently implementing the post-marketing surveillance studies concerning duodenoscopes that we started selling in the U.S. in 2020, further regulatory actions may be taken by the FDA depending on the future progress.

Between November 2022 and March 2023 Olympus received three Warning Letters in connection with FDA inspections of our Japanese facilities relating to certain issues with complaint handling, Medical Device Reporting, corrective and preventive actions, risk assessments, and process and design validation activities. Depending on future progress, additional regulatory actions may be taken by the FDA.

Countermeasures

The Olympus Group contributes to the improvement of healthcare services and quality of life of patients through its products that contribute to early diagnosis and minimally invasive treatment. Through product lifecycle management and infection prevention strategies, the Olympus Group is working on the development and selection of safe products that are in compliance with laws and regulations.

Through efforts such as, strengthening our capabilities to execute on critical regulatory/quality strategies and plans, as well as conducting periodic audits the Olympus Group will continue to focus and make compliance with all relevant laws and regulations a top priority.

The safety of patients is of utmost importance to the Olympus Group. It is essential that we respond to the findings of the regulatory authorities in each country. We will take corrective actions on past findings without delay and will ensure that we respond to the three most recent Warning Letters received by the Olympus Group from the FDA. We will also drive improvements in root causes (vulnerabilities) that may exist with our QARA organizational structure, manufacturing processes, quality management systems and the quality culture of our medical business.

Connection with company strategy and policies: Patient safety and sustainability

Risks Associated with Market Competition

- Type: Opportunity and threat

- Level of Impact/Urgency: A

- Tendency: Increase ↑

Risks

It is believed that there is a solid need for healthcare as societies progressively age, particularly in developed countries. There are efforts underway in various countries to reform healthcare systems, aiming to optimize rising healthcare costs and provide effective, high quality healthcare services.

Under such circumstances, there are many competitors in the business areas in which the Olympus Group is involved, and technological innovation is also progressing. Competition in the Therapeutic Solutions Business is intensifying more than ever before. Olympus Corporation needs to launch products that are competitive in terms of price, technology, quality, etc. into the market in a timely manner, but earnings may be adversely affected depending on the results. In the short term, we will introduce new products such as EVIS X1, and in the medium- and long-term, we see the possibility to gain opportunities from increased revenue from the progression of DX and endoscopic technology development.

We see the Chinese market as a market with particularly high growth potential in the medium- and long-term. At the same time, trade friction between the U.S. and China is intensifying, and uncertainty surrounding the Chinese market is intensifying in the form of policies favoring national production by the Chinese government and authorities and the promotion of concentrated purchasing. Furthermore, for the markets of emerging countries also, healthcare needs are increasing along with economic growth, with even more growth potential. Future political conditions, trends in policies and rules by governments and authorities, and the state of competition with competitors may have a large impact on the sales of the Olympus Corporation.

Countermeasures

The Olympus Group is not limited to conducting business operations in specific regions, but instead is working towards providing diverse products and services in various business fields and regions worldwide. In addition, in order to increase the number of physicians able to operate endoscopes, we are supporting the training of endoscopists, such as by providing training programs.

Moreover, the Olympus Group monitors the competitive environment, including the emergence of alternative technologies and products in the market, and works towards expediting the selection and development of new technologies that should be adopted in cooperation with marketing, intellectual property and relevant departments. We actively consider not only inhouse development, but also the incorporation of external technologies through M&A and alliances, etc. The Olympus Group is working towards the development of new high-value added products and technologies that meet the market needs. In the Endoscopic Solutions Business in particular, we have maintained a strong market share by expanding sales of the gastrointestinal endoscope system “EVIS X1,” and in the Therapeutic Solutions Business, we aim to increase earnings through expanding market share by strengthening our product lineup in the areas of GI-endotherapy, Urology, and Respiratory, and by promoting the development of next-generation medical devices such as single-use endoscopes.

In China, an important market, we are evaluating and promoting the following policies to respond to policies favoring national production

- Establishing manufacturing locations in China (including some research and development capabilities)

- Optimizing the overall supply chain globally

- Collecting various information related to U.S.-China relations

- Preparing response policies that consider the impact of contingencies (BCP formulation, etc.)

In emerging countries also, we are promoting activities to maximize opportunities such as establishing dedicated organizations and long-term investment in high-priority countries

Connection with company strategy and policies: Innovation for growth

Risks Associated with Market

Risks Associated with Economic Environment

- Type: Opportunity and threat

- Level of Impact/Urgency: C

- Tendency: Increase ↑

Risks

In addition to the war in Ukraine and trade friction between the U.S. and China, the Olympus Group’s earnings may be adversely affected by changes in the economic environment, such as the materialization of geopolitical risks and trends in resource prices that lead to global inflation and sudden exchange fluctuations.

The Olympus Group provides products and services in the endoscopic solutions business, therapeutic solutions business, etc. to customers worldwide. However, the earnings from these businesses are largely affected by the global economy and economic trends in each country.

Earnings in the medical field may be adversely affected if the national budgets of countries are curtailed or if there is a change in policy, etc.

In the meantime, opportunities may emerge for increased earnings, etc., if there is an increase in related national budgets due to policy, etc.

Countermeasures

The Olympus Group is not limited to conducting business operations in specific regions, but instead is working towards providing diverse products and services in various business fields and regions worldwide. In the event a situation arises that requires particular attention with regard to a particular country’s policies for industrial development and protection of its own industries, etc., we will set up a task force and make regular inhouse reports as necessary.

Connection with company strategy and policies: Innovation for growth

Risks Associated with Foreign Currencies Exchange Rate Fluctuations

- Type: Opportunity and threat

- Level of Impact/Urgency: D

- Tendency: Increase ↑

Risks

The Olympus Group provides products and services in various markets all over the world. The Olympus Group’s business performance may be adversely affected by a strong yen, while it may be positively affected by a weak yen. We hedge foreign currency-denominated receivables and payables where possible, however in the event that sudden exchange fluctuations occur or if receivables and payables being hedged differ significantly from expectations, the Olympus Group’s business performance may be adversely affected.

Countermeasures

The Olympus Group uses derivative instruments such as forward exchange contracts, currency swaps, etc. to reduce the risk of exchange fluctuations. Furthermore, we are working to reduce foreign currency-denominated receivables and payables through improving the efficiency of the Olympus Group’s funds by introducing global cash pooling.

Connection with company strategy and policies: Innovation for growth

Risks Associated with Financing

- Type: Opportunity and threat

- Level of Impact/Urgency: D

- Tendency: Unchanged →

Risks

The Olympus Group finances itself by, among others, loans from financial institutions as well as issuance of bonds. Changes in the financial markets may have an adverse impact on our financing capacities.

Furthermore, if the financing cost rises due to the deterioration of the Olympus Group’s business performance, etc., the financing of the Olympus Group may be adversely affected, while if the financing cost decreases due to the improvement of the business performance, etc., it may be positively affected.

Countermeasures

The Olympus Group is reducing funding costs through the diversification of funding methods such as the issuance of commercial paper and public bonds. The Olympus Group basically adopts a fixed interest rate policy for long-term interest-bearing debt to limit the impact of rising interest rates. In addition, we are working to improve the efficiency of the Olympus Group’s funds and strengthen financial management by introducing global cash pooling.

Connection with company strategy and policies: Innovation for growth

Risks Associated with Business Activities

Risks Associated with Development Activities

- Type: Opportunity and threat

- Level of Impact/Urgency: A

- Tendency: Unchanged →

Risks

In the medical field, the Olympus Group faces more rapid changes and uncertainties in the social environment than ever before, mainly due to aging population and growing environmental awareness. The hurdles and complexities for technology development are increasing due to changes in healthcare policies in various countries, reductions in healthcare costs, tighter healthcare-related laws and regulations, and further increased demands for infection prevention and reprocessing. In Europe and the United States, awareness of environmental issues has reached remarkable levels. In response to this, there is a trend towards shortened development cycles being requested.

On the technology front, digital transformation (DX) is accelerating across all domains, and the so-called technology innovation areas (AI/robotics/ICT) are entering their practical phase. Accordingly, the business environment is becoming more demanding, not only due to new and alternative technologies, but also due to the entrants into the medical industry from other industries, including the IT technology giants. Furthermore, in the medical field, the Olympus Group aims to improve patient outcomes, by expanding the care pathway centered on GI-endotherapy, Urology, and Respiratory and contributing to the improvement of medical care standards through technological development and innovation, in accordance with its patient-first approach. We believe it is important to balance not only “continuous innovation,” in which improvements are made to existing products and technologies to meet customer needs, but also “disruptive innovation,” in which technologies are put to practical use based on new ideas in response to changes in the social environment. If market changes cannot be properly predicted or product development does not progress as planned, and the Olympus Group fails to develop new products which properly meets customers’ needs in a timely manner, the Olympus Group’s earnings may be adversely affected. In addition, there may be impairment losses on capitalized R&D assets due to an increase in expenses associated with a longer development period or a relative decrease in the recoverable amount.

Opportunities include the advancement of technological development in the Olympus Group’s focused areas and its contribution to healthcare by providing solutions to unmet needs, as well as the potential for minimally invasive treatments, reduced healthcare costs, and reduced workloads for healthcare professionals through the spread of robotics technology in the medium- and long-term.

Countermeasures

The Olympus Group has established an organizational structure for agile and concurrent technological development focused on the medical field. In addition, we have adopted the following comprehensive approach to technology development and innovation, and are focusing on acquiring and training the diverse human resources to promote it. (1) continuous technical development for existing businesses and products; (2) appropriate product lifecycle management to ensure product safety, improve development efficiency, and reduce development costs; (3) technology acquisition and product portfolio expansion through M&A; (4) consideration of business collaborations, internal/external production, and other business strategies, taking into account Olympus Corporation’s core technologies, costs, and development timeframes; and (5) innovations for future businesses that open the way to the resolution of social issues and development of environmentally friendly products, etc.

Our technical approach to existing products must include initiatives to expand the product lineup, comply with product-related laws and regulations, support infection prevention and reprocessing, and enhance product security. In addition, preparing multiple lineups for single-use endoscopes, whose market needs are increasing due to increasing awareness of infection control, is a high-priority development theme. We are also accelerating our DX efforts and are about to start fully utilizing digital technology in our services. Furthermore, for the near future, in order to optimize the entire clinical process and build new business models, we are also studying the use of more advanced AI and ICT, and the use of robotics for next-generation minimally invasive surgery. Through these kinds of development activities, we will focus on and build solutions to improve, the series of care pathways that patients follow from prevention to care and prognosis.

Connection with company strategy and policies: Patient safety and sustainability, Innovation for growth, Productivity

Risks Associated with Supply Chain

- Type: Opportunity and threat

- Level of Impact/Urgency: A

- Tendency: Unchanged →

Risks

The Olympus Group needs to develop products, procure necessary parts, etc. from outside suppliers, produce, and supply products in a timely manner. The number of potential high-impact supply chain risk events are increasing, especially driven by increased geopolitical tensions, cyber attacks, high-impact weather events and global trade lane disruptions and uncertainty in the procurement of raw materials and components to the supply of products has increased in recent years. Material price increases and product shortages resulting from external issues (e.g. increasing trade barriers and lower raw material availability) requires intensive focus on strong supplier management.

For products and parts, etc. that depend on certain suppliers, if the procurement is restrained, the Olympus Group’s ability to produce and supply products may be interrupted or delayed. These macroeconomic uncertainties and geopolitical threats may have a significant impact on the production structural reform and overall supply chain optimization being implemented in the manufacturing and supply sectors.

With regard to the global shortage of semiconductors and other components, the overall supply-demand balance is stabilizing and the risk is decreasing. However, the supply of semiconductors that we procure is limited and supply shortages could be prolonged, so we continue to need to exercise caution.

If the production and sales of products are stagnant due to geopolitical risks, natural disasters, plagues, wars, civil wars, riots, terrorism, cyber attacks, strikes by port workers, transportation accidents, etc., loss of sales opportunities due to delivery delays, and the increased cost of recovery measures may affect our profitability.

The Olympus Group and its manufacturing contractors manufacture products in accordance with strict quality standards. However, if any product deficiency, malfunction, etc. occurs, not only substantial costs including those of a recall would be incurred but also the Olympus Group’s reputation from the market would be undermined, which may adversely affect the Olympus Group’s earnings.

On the other hand, properly addressing these supply chain risks and challenges can lead to improved production efficiency, stable product supply, and customer confidence, thereby increasing the potential for opportunities to increase revenues.

Countermeasures

In this increased VUCA environment, our activities focus on creating a highly transparent, integrated and resilient Supply Chain. With a view to business continuity and sustainable value creation, the Olympus Group has established the Supply Chain Policy and the Olympus Group Green Procurement Standards, and is working to strengthen compliance with laws, regulations, and social norms. For our suppliers, we have established concrete guidelines or complying with laws, regulations, and social norms, prohibiting corruption and bribes, promoting fair and lawful transactions, and taking the environment into consideration. Based on these guidelines, the Olympus Group is working to create and strengthen good relationships based on fair, just, and transparent transactions. The Olympus Group also ensures transparency in our supply chains and continue the procurement of parts and materials that does not cause human rights violations.

The Olympus Group aims to strengthen supply chain management (SCM) and constructs an End-to-End integrated supply chain that stretches from purchasing to delivery, and focuses on improving customer satisfaction and business agility, reduced supply chain costs and optimized inventories. Goal of the End-to-End Supply Chain Transformation is to enhance planning and distribution processes and capabilities to manage the effects of these risks in close collaboration with Manufacturing and Procurement, and limit the impacts of those external headwinds. Newly created global distribution function (part of the End-to-End Supply Chain Transformation) is overseeing and coordinating risk mitigation and countermeasures to ensure stable distribution and timely escalation of issues and support needs. We proceed close collaboration and quick decision structures between Supply Chain, Procurement, Manufacturing and business functions.

Olympus Corporation aims to reduce supply issues through measures such as grasping supplier trends and strengthening relations with suppliers and enhancing a business continuity plan (BCP) including backup plans. In particular, with regard to the procurement of semiconductors, Olympus Corporation has established a company-wide task force and is working to secure the necessary volume by strengthening relationships with suppliers. To ensure a stable supply of products, Olympus Corporation sets appropriate inventory levels at each site and takes measures to respond to end-to-end supply chain changes by building a risk management system that integrates manufacturing, procurement, and supply chain. In addition, Olympus Corporation aims to curtail quality issues by implementing quality improvement activities such as separating the product development process into business reviews, technology reviews, etc. From a manufacturing perspective, we are working to optimize manufacturing costs through global production load optimization, internal/external manufacturing studies, promotion of value engineering, and promotion of manufacturing DX.

Connection with company strategy and policies: Patient safety and sustainability, Innovation for growth, Productivity

Risks Associated with Business Collaborations, Corporate Acquisitions, Sale of Business and Overall Investment and Others

- Type: Opportunity and threat

- Level of Impact/Urgency: A

- Tendency: Unchanged →

Risks

The Olympus Group has been focusing its business portfolio, prioritizing investments especially in the areas of GI, urology, and respiratory. The Olympus Group is investing in capital expenditures, research and development, and other investments related to its business, and its business performance and financial position may be adversely affected if there is an unforeseen change in circumstances, such as a sudden change in the external environment from the timing the decision was made in relation to such investment.

The Olympus Group has built long-term strategic partnerships with leading enterprises in connection with technologies, product development, sales and marketing. If these strategic partners have financial or any other business-related issues, or the Olympus Group and such partners fail to maintain their partnerships due to reasons such as change of strategies, the Olympus Group’s business activities may be adversely affected.

The Olympus Group may acquire a business enterprise in order to expand its business. If the Olympus Group fails to integrate the acquired business appropriately in line with its corporate strategy or to utilize the existing business or the acquired business in an efficient manner, the Olympus Group’s business execution may be adversely affected, or its business performance and financial position may be adversely affected due to impairment of goodwill or other related expenses.

The Olympus Group holds investment securities for business purposes which include facilitating business alliances. As such, our business performance and financial position may be adversely affected under some situations involving considerable volatility with respect to stock prices and valuations of such investments brought about by developments that include market fluctuations and changes in the financial position of entities targeted for investment.

In addition, as part of the strategic review of the business portfolio, Olympus Corporation may sell affiliated companies or businesses positioned as non-core, however, if changes in the laws and regulations of each country, economic conditions, and business conditions of counterparties make it difficult to implement the sale, or if there is a loss on sale or valuation loss occurs, it may have a management or financial impact on the Olympus Group.

Through business alliances and corporate acquisitions conducted under appropriate countermeasures, Olympus Corporation may expand the product portfolio and acquire new technologies, establish leading positions in targeted therapeutic areas and diseases, and realize long-term growth and corporate value.

Countermeasures

The Olympus Group determines whether to invest or not, deliberating the appropriateness of the investment evaluation before investing, and continues to evaluate investments afterward in response to changes in the external environment and other factors. When considering M&A and investment, it is necessary to reduce the risk of serious problems being discovered after the conclusion of a contract. Accordingly, before making a decision on whether to proceed with an investment, Olympus Corporation deliberates the appropriateness of the investment evaluation in accordance with approval processes established by Olympus Corporation, while undertaking various types of due diligence and also using outside lawyers and financial advisors. In addition, Olympus Corporation is working towards improving the entire investment process through periodically revising the internal guidelines for adhering to compliance, the valuation model and the matters of due diligence, and monitoring the relevant business after the completion of the transaction.

Connection with company strategy and policies: Innovation for growth, Productivity

Risks Associated with Compliance

- Type: Threat

- Level of Impact/Urgency: D

- Tendency: Unchanged →

Risks

The Olympus Group and many of its distributors and suppliers engage in business with government-affiliated companies, medical institutions, and officials. The Olympus Group globally operates its businesses, including the medical business, which is a regulated business. We are subject to various laws, including the healthcare-related laws, antimonopoly laws both in Japan and other jurisdictions, as well as the anti-bribery provisions of the U.S. Foreign Corrupt Practices Act of 1977 (FCPA), the U.K. Anti-Bribery Act and other anti-bribery laws in other jurisdictions. We are also subject to various laws targeting fraud and misconduct in the healthcare industry, including the Act against Unjustifiable Premiums and Misleading Representations in Japan, and the Anti-Kickback Statute and the False Claims Act in the United States. It is also necessary to take steps to maintain a high level of compliance among the business partners (dealers, suppliers) with which the Group has developed relationships of trust.

Violations of these laws may be punishable by criminal or civil fines and/or exclusion from participation in certain national healthcare programs. Furthermore, since many of our customers rely on reimbursement from public health insurance and other government programs to subsidize their medical expenditures, if our participation in such programs is restricted as a result of a violation of these laws, it could adversely affect the demand for our products and the number of medical procedures performed with our products.

The Olympus Group is subject to privacy regulations worldwide. However, Olympus Corporation may be adversely issued with a fine or other penalty from a government agency or where a lawsuit may be adversely filed against Olympus Corporation by a stakeholder as a result of a violation of personal information protection laws of a particular country worldwide (Act on the Protection of Personal Information in Japan, General Data Protection Regulation (GDPR) in the EU, etc.)

The Olympus Group strives to fully comply with these laws, however, if the Olympus Group violates any of them, regardless such violation is intentionally or not, it may affect the Olympus Group’s business, financial position, results of operations, cash flows, and share price.

Countermeasures

The Olympus Group makes its employees adhere thoroughly to the compliance of laws and regulations in their performance of duties as outlined in the Global Code of Conduct and provides training to employees on the importance of preventing corruption and compliance with each country’s competition-related laws. In addition, the Olympus Group conducts compliance training and auditing of distributors and third parties throughout the world.

Departments performing control functions, such as Legal, Compliance and Internal Audit, monitor the business activities from the perspective of whether such activities are complying with the laws, regulations and internal guidelines that are applicable to the Olympus Group. In addition, necessary and appropriate training and education is provided to employees. Also, we provide a global reporting system, which is available to all Olympus employees, third parties, and the general public who may wish to report a concern. This system is operated by an independent third party and is available 24 hours a day, seven days a week, 365 days a year, in multiple languages. The Olympus Group is constructing a structure to collect information and monitor regulations related to Olympus Corporation’s business in all markets where business is being developed. In addition, if there are amendments or changes to applicable laws or regulations, the Olympus Group ensures there is a thorough knowledge of such changes by employees while swiftly developing and supplying products corresponding to such amendments or changes.

In response to risks related to personal information protection regulations, the Olympus Group has formulated a security and privacy compliance strategy in the fiscal year ended March 31, 2022, and are strengthening its response capabilities, including the assignment of specialized personnel related to personal information protection in each region, as well as strengthening its global structure to ensure cooperation throughout the Olympus Group.

Connection with company strategy and policies: Patient safety and sustainability, Productivity

Risks Associated with Litigation

- Type: Threat

- Level of Impact/Urgency: D

- Tendency: Unchanged →

Risks

The Olympus Group may be subject to lawsuits, disputes and other legal proceedings in connection with its domestic and international businesses. If a material lawsuit such as indemnity claim or injunction is filed by a third party, the Olympus Group’s business performance and financial position may be adversely affected.

Olympus Corporation uses various intellectual property rights in the course of its R&D and production activities, and although it believes that the Olympus Group lawfully owns or are licensed to use such rights, if any third party asserts that the Olympus Group has unknowingly infringed any of these intellectual property rights and files litigation, the Olympus Group’s earnings may be adversely affected.

Olympus (Shenzhen) Industrial Ltd., a consolidated subsidiary in Shenzhen, China and owned by Olympus (China) Co., Ltd., another consolidated subsidiary, is engaged in two (2) separate business disputes initiated by Shenzhen Anping Tai Investment and Development Co., Ltd. and Shenzhen YL Technology Co., Ltd. . The Olympus Group’s business performance and financial position may be adversely affected depending on future developments in these matters.

Countermeasures

Olympus Corporation has established a structure and process that enables timely consultation with external experts such as lawyers if a lawsuit or other legal proceeding arises and is strengthening the skills and expert knowledge in applicable departments in each regional headquarter in Japan, the Americas, Europe, China and Asia・Oceania. In addition, Olympus maintains insurance to prepare for certain types of unexpected losses due to lawsuits in order to minimize financial risk.

Connection with company strategy and policies: Innovation for growth

Risks Associated with Information Security

- Type: Threat

- Level of Impact/Urgency: A

- Tendency: Increase ↑

Risks

In order to ensure the stable and continuous supply of our products and services, Olympus Corporation strives to reduce information security risks, such as preventing the leakage of confidential and personal information of Olympus Corporation and stakeholders, and preventing violations of laws and regulations, in preparation for cyberattacks that could hinder business continuity. Nevertheless, due to the rapid increase in cyberattacks targeting medical institutions, manufacturers, and their supply chains worldwide, and the increasing sophistication and organization of these attacks, the following unforeseen events could damage the Olympus Group’s corporate value, reduce its business competitiveness, cause a loss of public trust, cause compensation to affected stakeholders, or result in sanctions or fines from authorities in other countries, which could affect its business performance and financial position.

Cyberattacks targeting products of Olympus Corporation that are installed at medical institutions may result in customer medical institutions being unable to continue providing examinations or treatment procedures, or may result in the personal information of patients being leaked or lost.

Cyberattacks targeting medical institutions that are Olympus Corporation’s customers may result in the leakage of patient information through the use of its products or their maintenance work, making it impossible for its customers to continue their business.

Cyberattacks targeting Olympus Corporation or its supply chain could disrupt operations at Olympus Corporation or prevent it from providing maintenance services, resulting in the inability of medical institutions to continue examinations or treatment procedures.

An incident where technological information or customer information is leaked or lost while stored in Olympus Corporation due to inadequate information security measures or internal misconduct.

Risks associated with the continuity of the above medical treatments are recognized by the regulatory authorities in various countries, and not only new products but also existing products are required to deal with information security and cybersecurity risks related to the product and its supply, as part of product safety.

Countermeasures

In order to minimize the impact on customers, business partners, and Olympus Corporation’s business performance by responding more promptly in the event of unauthorized access due to cyberattacks, etc., the Olympus Group is working to strictly implement education on a periodic basis for all employees and establish an incident response system covering the entire Olympus Group.

In addition to the above, in order to further strengthen existing activities, new security and privacy compliance strategies and a governance model to execute them were drawn up in the fiscal year ended March 31, 2022 with the aim of enabling risk management for information/cybersecurity and privacy throughout the Olympus Group, and to enable the strategy roadmap to be implemented consistently over multiple years. Following this, the building of a global structure for the related functions necessary to execute the strategy roadmap and the execution of the roadmap measures will commence in the fiscal year ended March 31, 2023. Specifically, we have begun initiatives such as putting in place a global response system for cyberattacks, standardizing processes globally for information asset management in the product development and manufacturing environment, and standardizing processes globally for ensuring security at the development phase and for responding to customer inquiries about security. This will enable the Olympus Group:

To increase resilience to cyberattacks not only in general IT systems, but also in product development and manufacturing environments.

To approach security as part of product safety, to ensure product security not only at the development stage but throughout the entire lifecycle of the product, and to maintain stable supply of product throughout the supply chain, including our suppliers.

To further enhance privacy protection based on the latest trends, and laws and regulations in each country and region, as well as provide protection and utilization of various types and levels of confidentiality of data.

Connection with company strategy and policies: Patient safety and sustainability, Innovation for growth, Productivity

Risks Associated with Human Resources

- Type: Opportunity and threat

- Level of Impact/Urgency: A

- Tendency: Increase ↑

Risks

In order to remain competitive, the Olympus Group must continue to recruit and retain the talented and diverse human resources it needs to conduct its business. In the industries in which the Olympus Group operates, competition for talent is intensifying globally, and some regions have seen an increase in retirement rates due to changes in the labor market as a result of the COVID-19 pandemic. Recruitment, development, and retention of personnel is becoming increasingly important. Through such measures as promoting Diversity, Equity and Inclusion initiatives and respecting human rights, the Olympus Group aims to foster a healthy organizational culture in which every individual is able to demonstrate their performance in optimal conditions. However, if Olympus Corporation were unable to recruit and retain highly skilled personnel, this may affect the supply of future products and services and impact sustainable growth.

Countermeasures

The Olympus Group believes that it is important to ensure that each employee has a deep understanding of the Olympus Group’s common philosophy and values and that highly specialized personnel are placed in the right places on a global basis. To achieve this, we conduct activities to instill our philosophy and values, and develop skills training programs and similar initiatives. We have defined the duties required to carry out our corporate strategy, introduced a globally common talent management system, and created a successor development plan starting from the most important positions. We are also working to develop a system that will enable diverse personnel, regardless of nationality, gender, etc., to play an active role and continue to demonstrate a high level of professionalism. To this end, we have established a global common leadership competency model and are putting in place programs to support demonstration of leadership. This program aims to foster a culture and develop human resources so that employees keep performing at a high level. With regard to compensation, we are always aware of market trends and offer competitive compensation levels and compensation packages to our employees. For example, in the Japan region, we shifted to a compensation system that better reflects job performance and results from April 2023. In addition, the Olympus Group as a whole, including Japan, ensures fairness through a common global job evaluation and compensation policy. Also, we will aim to raise the level of compensation and at the same time increase commitment to achieving medium- and long-term goals by granting share-based compensation to employees above a certain level. With regard to human resources recruitment, including regular hiring of new graduates etc., we are hiring personnel with specialized skills on an irregular basis, and we are strengthening our human resources recruitment system and enhancing our onboarding efforts so that employees who join Olympus Corporation can play an active role as soon as possible.

Connection with company strategy and policies: Patient safety and sustainability, Innovation for growth, Productivity

Risks Associated with Taxation

- Type: Threat

- Level of Impact/Urgency: D

- Tendency: Unchanged →

Risks

Olympus Corporation’s tax burden may be increased due to changes in applicable tax laws or changes in their interpretations and application guidelines in jurisdiction of each country in the world. The valuation allowance for deferred tax assets may need to be increased as a result of recoverability reassessment due to changes in business conditions or the implementation of organizational restructuring. If such situations occur, it may adversely affect the Olympus Group’s business performance and financial position.

Countermeasures

In regard to changes in applicable tax laws in each jurisdiction, or changes in their interpretations and application guidelines, the Olympus Group is monitoring the amendments to laws and changes in regulations and making changes as appropriate to rules for transactions within the Olympus Group. In regard to deferred tax assets, the Olympus Group is monitoring the profitability of each group company and controlling the financial results so that the respective companies can appropriately secure profitability while also paying close attention in cases of business combinations for changes in profitability following such restructuring in order to minimize risks.

Connection with company strategy and policies: Innovation for growth

Sustainability risks, including those related to climate and the environment

- Type: Opportunity and threat

- Level of Impact/Urgency: C

- Tendency: Unchanged →

Risks

Olympus Corporation is receiving increasing demands from the perspective of sustainability from stakeholders, including customers. For example, in Europe, cases in which customers add a sustainability perspective (ESG and BCP) to bidding requirements are on the rise, and the same trend can be seen in other regions. There is also a trend towards not only targeting Olympus Corporation but also its supply chain inclusively. Disclosure of sustainability information is progressively being enshrined in law in every region. Such legislation is making progress not only in Japan but also in Europe (EU CSRD) and the United States (SEC), and this could affect Olympus Corporation going forward. If we were to fail to respond to these requests from stakeholders, there is the risk of the business being unable to participate in bidding, of investors applying investment restrictions, and of corporate activities being constrained, depending on the region.

Regarding the environmental field, the Olympus Group recognizes environmental challenges such as mitigating and adapting to climate change, conserving water resources, controlling resources sustainably, and protecting biodiversity. The introduction of carbon taxes, carbon dioxide emission controls, resource recycling regulations, chemical substance management, and other regulations aimed at achieving a decarbonized and recycling-oriented society could increase business costs around the world. In addition, the intensification of natural disasters caused by climate change is likely to affect the operations and supply chains at our own sites. Failure to take appropriate action may result in loss of business opportunities, etc.

We recognize that by responding appropriately to sustainability matters, including climate and the environment and by balancing sustainable corporate growth with global issues, we build trust in each region and with all stakeholders over the medium- and long-term, and enhance corporate value that is not limited to profitability alone.

Countermeasures

With an overall perspective of sustainability, our ESG team plays a central role in promoting activities to realize ESG materiality defined through our business activities (integration of functional strategy and ESG strategy).

Regarding the environmental field, the Olympus Group has established specialized functions to promote environmental activities, and has established an environmental management system in line with ISO 14001. Under this system, we promote compliance with environmental laws and regulations through maintenance of rules and regulations, education of environmental managers and implementors, and monitoring and improvement of local operations.

In April 2021, the Olympus Group also announced support for Task Force on Climate-Related Financial Disclosures (TCFD), promoting “contribution to the realization of a decarbonized and recycling-oriented society in cooperation with society” as a material issue (materiality). Olympus Corporation set two ambitious goals: to achieve virtually zero carbon dioxide emissions (Scope 1 and 2*) from our own sites by 2030, while aiming for carbon neutrality throughout the product lifecycle in the long term; and to obtain 100% of the electricity used at our sites from renewable energy sources by 2030.

In order to contribute widely to the realization of a decarbonized society, in addition to the carbon dioxide emissions from the company itself, we believe that it is also necessary to strive to include carbon dioxide emissions from the supply chain. Accordingly, in May 2023, we set a goal of net zero carbon dioxide emissions (Scope 1, 2, 3) for the entire supply chain by 2040. This goal is in line with a high-level target of 1.5°C, which is the target to strive for under the Paris Agreement.

To achieve these goals and as countermeasures to environmental risks in our supply chain, we will implement manufacturing improvement activities and introduce renewable energy at bases around the world, and also continue to develop environmentally friendly products, improve the efficiency of logistics, set voluntary reduction targets in cooperation with suppliers, and continue to support decarbonization activities.

* Scope 1: Direct greenhouse gas emissions from onsite fuel use; Scope 2: Indirect greenhouse gas emissions from onsite electricity and heat use;

Scope 3: Other indirect greenhouse gas emissions (other than Scope 1 and Scope 2)

Connection with company strategy and policies: Patient safety and sustainability

Natural Disasters, Infectious Diseases, War, Civil War and Other Risks

- Type: Threat

- Level of Impact/Urgency: C

- Tendency: Increase ↑

Risks

Occurrence of natural disaster, infection, war, civil war, riot, terrorist attack or economic sanction may adversely affect the Olympus Group’s earnings.

Countermeasures

When there is a serious crisis, a Crisis Response Team is established in accordance with crisis response rules that are applicable to the Olympus Group as a whole, striving to manage the crisis to minimize the negative impact on corporate value. Moreover, the Olympus Group strengthens the response to business interruption risk through the formulation and periodic revision of a business continuity plan (BCP) and education and training to increase the effectiveness of the BCP even in peacetime.

Connection with company strategy and policies: Innovation for growth

May 19, 2023 Updated